0The Supreme Court Hears Oral Argument on the Standard for Pleading a Breach of the Duty of Prudence in Excessive-Fee Cases

On December 6, 2021, the U.S. Supreme Court heard oral argument in Hughes v. Northwestern University, a case about the standard for pleading a plausible claim for breach of the duty of prudence when challenging a defined-contribution plan’s investment line-up or recordkeeping arrangements. The Justices seemed uncertain both about how to articulate a pleading rule that would allow plausible claims to proceed while weeding out speculative ones, and also about which category the plaintiffs’ allegations fall into. For further analysis of the Northwestern case, our takeaways from the oral argument are available here, and we discussed the pending appeal before the Supreme Court in the last edition of the ERISA Litigation Update, which is available here.

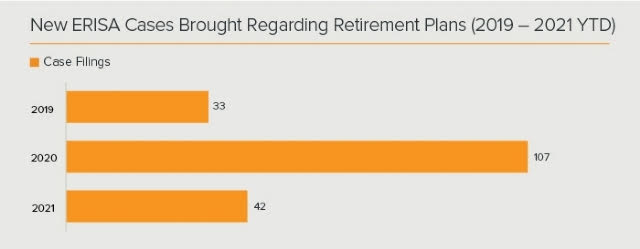

0Trends in ERISA Litigation Concerning Retirement Plans

Key Takeaway: Although fewer new cases were filed in 2021 than 2020, plaintiffs in ERISA cases have continued to experience success and we expect that, barring changes in the law or a favorable opinion for the defense in the Northwestern case or others, ERISA litigation will continue to be a hot area of the law into 2022 and beyond.

2021 was another very active year in ERISA litigation, particularly in cases concerning retirement plans. Although the number of new ERISA cases filed in 2021 concerning retirement plans did not match 2020’s record of over 100 new cases, over 40 were still filed in 2021, approximately ten more than were filed in 2019. The decline in new cases filed in 2021 as compared to 2020 may be simply due to the fact that plaintiffs’ firms are busy with the cases filed last year, most of which are still working their way through the courts. Trends, including the following, indicate that this new normal of increased ERISA litigation may continue:

- New plaintiffs’ firms have entered the space: Particularly in 2020, but also in 2021, we have seen plaintiffs’ firms that have not historically been active in ERISA cases file lawsuits. Some of these firms have filed many lawsuits; one firm alone filed over 40 ERISA cases in the past three years.

- Lawsuits have been brought against sponsors and fiduciaries of smaller retirement plans: In earlier waves of ERISA litigation, lawsuits mainly concerned very large, multi-billion dollar plans. Plaintiffs’ firms then began to sue regarding plans with several hundred million dollars of assets. Now, even companies with plans under $100 million in assets have been sued.

- Most cases have survived motions to dismiss: Many courts have been reluctant to grant motions to dismiss, although as plaintiffs target plans that have different characteristics, that might change. In cases filed since 2019, courts have denied dismissal in part or in whole in nearly three-quarters of contested motions to dismiss. One notable outlier has been in California district courts, where four out of nine such motions were granted. Goodwin profiled two of these decisions in an earlier edition of the ERISA Litigation Update, available here.

- Classes have been certified in most cases: To date, courts also have been reluctant to deny class certification in many ERISA fee cases. Indeed, some defendants now stipulate to class certification rather than oppose the motion to certify a class. Defendants have fared best in cases where plaintiffs seek to certify classes consisting of many plans or participants in many plans. For example, a Goodwin client recently prevailed in opposing class certification in such a case. More information on that favorable decision is available here.

- Settlements have continued: And, ultimately, many cases have still ended in settlements. Several eight-figure settlements were approved in 2021. Generally, 2021 settlement amounts were similar to those in prior years, after taking into account the size of the plans at-issue.

0Investment Manager Prevails at Trial Challenging Its Investments

Key Takeaway: A plan’s delegated investment manager recently prevailed at trial against claims alleging that it breached its fiduciary duties by selecting its own investments for a client’s retirement plan, in a ruling that could be helpful for other defendants facing suits regarding use of proprietary investment products in retirement plans.

On October 12, 2021, the U.S. District Court for the Western District of North Carolina ruled after a five-day bench trial that defendant Aon Hewitt Investment Consulting had not breached its fiduciary duties as a delegated investment manager under ERISA 3(38) in connection with the Lowe’s 401(k) Retirement Plan. The plaintiff had originally brought suit against both Aon and Lowe’s, alleging that each had breached their duties of loyalty and prudence by replacing some of the Lowe’s plan’s then-existing investment options with those managed by Aon. In particular, the plaintiff alleged that the investments at-issue should not have been selected where they lacked a track record at the time of their selection for the plan, and further that the investments later underperformed the funds they replaced in the plan. Lowe’s settled the claims against it in 2021 and the trial proceeded against Aon.

The district court ruled based on the trial record that Aon had acted prudently and loyally. Although the plaintiff put forth evidence that Aon had not specifically analyzed whether other managers’ investment products were a better fit for the Lowe’s plan than Aon’s investments, the court found this was unnecessary where the evidence reflected that Lowe’s hired Aon in contemplation that Aon investment products would be utilized for the Lowe’s plan and that Aon was generally knowledgeable about other managers’ products. The court also determined that Aon had not breached its duties in selecting for the Lowe’s plan an equity fund that contained fixed income exposure and therefore underperformed during the recent bull market. The court reasoned that the fund’s strategy was not unreasonable at the time it was selected for the plan, and that Aon had not breached its duties in maintaining the fund in the plan where its later underperformance was expected based on the fund’s strategy and the market conditions at the time. Finally, the court ruled it was not a breach to include in the Lowe’s plan an investment option that lacked a long track record where the investment option’s investment decisions were generally made by subadvisors that had lengthy track records. Plaintiff have appealed the decision.

The case is Reetz v. Lowe’s Companies, Inc., No. 18-00075, in the U.S. District Court for the Western District of North Carolina, and the decision is available here.Contributors

- /en/people/h/hennecken-christina

Christina L. Hennecken

Partner - /en/people/r/rosenberg-dave

Dave Rosenberg

Counsel - /en/people/s/santos-jaime

Jaime A. Santos

PartnerCo-Chair, Appellate & Supreme Court Litigation - /en/people/s/schneider-george

George R. Schneider

Contacts

- /en/people/f/fleckner-james

James O. Fleckner

PartnerChair, ERISA Litigation - /en/people/d/douglass-alison

Alison V. Douglass

Partner