Amendments adopted by the U.S. Securities and Exchange Commission (SEC) have changed a variety of SEC rules, forms and schedules related to disclosure and payment of SEC filing fees. As summarized in an SEC fact sheet, the most visible changes for most filings will be (1) replacing the current fee table on the cover page and in the EDGAR submission header of most fee-bearing SEC filings with new fee table exhibits and (2) changes in fee payment methods. The amendments will improve and expedite SEC review of filing fee calculations. The new methods for payment of filing fees will provide filers with more flexibility, but will also require companies to consider how their choice of fee payment methods may affect timely fee payment in order to avoid the consequences of late fee payments. The amended rules, forms and schedules that implement the new fee table exhibits became effective on January 31, 2022. The amended fee payment rules will become effective on May 31, 2022. The Interactive XBRL tagging requirements for fee table exhibits will become effective on July 31, 2024 (large accelerated filers) and July 31, 2025 (all other filers).

Practical Considerations

Two areas of focus under the prior SEC filing fee regime will continue to require attention. First, fee offsets and carryforwards should be reviewed and calculated with care because the basis and calculation of fee offsets will be more transparent and more easily reviewed by the SEC. Second, although the amendments will update permitted fee payment methods to include automated clearing house (ACH) transfers and payments by debit cards and credit cards, subject to a variety of conditions discussed below, in most cases the new fee payment methods will not be processed immediately and some may involve delays of one to three business days before funds are available to the SEC for fee payments. These delays may increase the potential for untimely payment of SEC registration fees. In addition, companies may need to consider other limitations on the new fee payment methods, such as a $25,000 daily and per-filing-fee limit on credit card payments. The amendments do not significantly change the risks in either of these areas, but are likely to make inadvertent errors more visible.

Amended Forms and Schedules

The amendments affect the following filings under the Securities Act of 1933: Form S-1, Form S-3, Form S-4, Form S-8, Form S-11, Form F-1, Form F-3 and Form F-10. The amendments also affect the following schedules filed under the Securities Exchange Act of 1934: Schedule 13E-3, Schedule 13E-4F, Schedule 14A, Schedule 14C, Schedule TO and Schedule 14D-1F. These amendments are effective January 31, 2022.

Filing Fee Information Disclosure

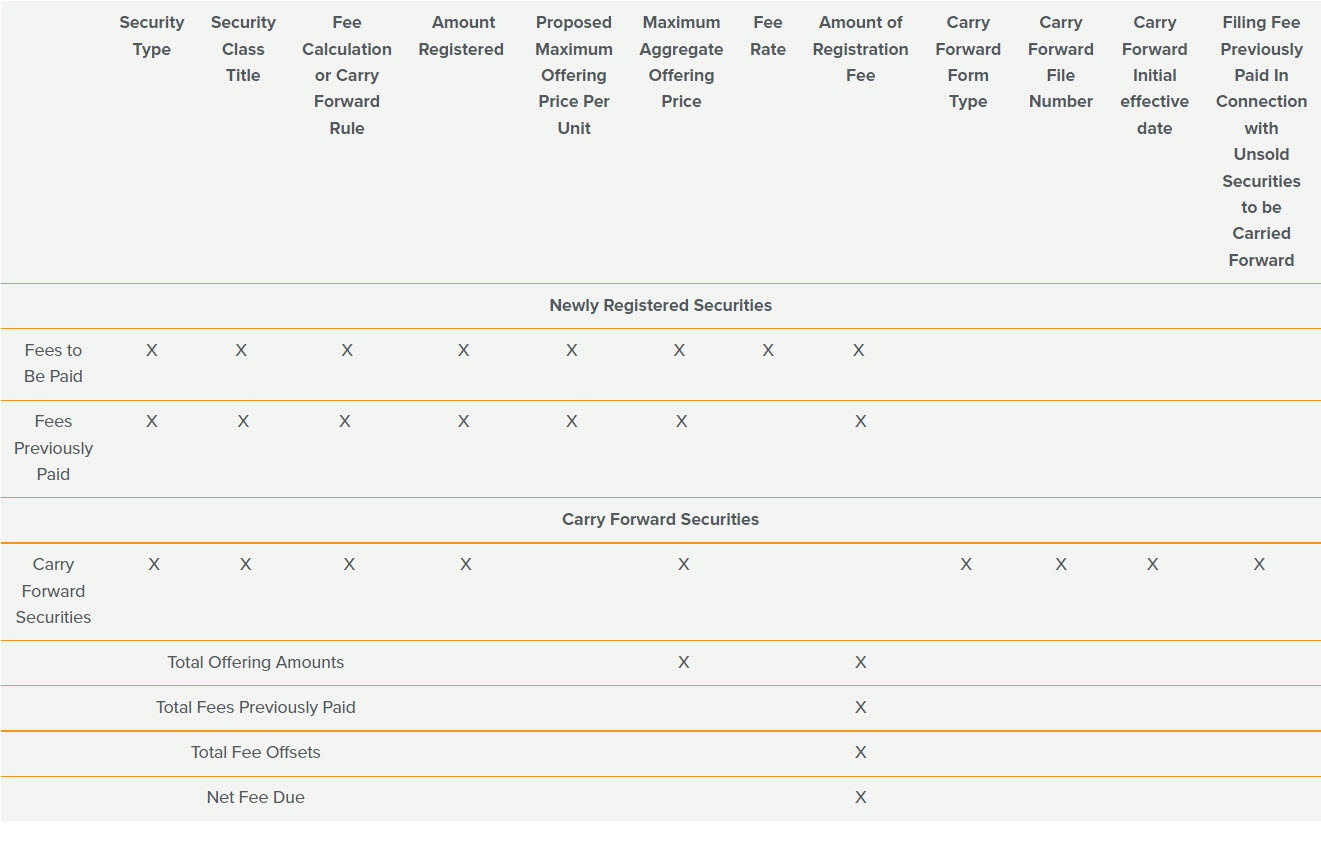

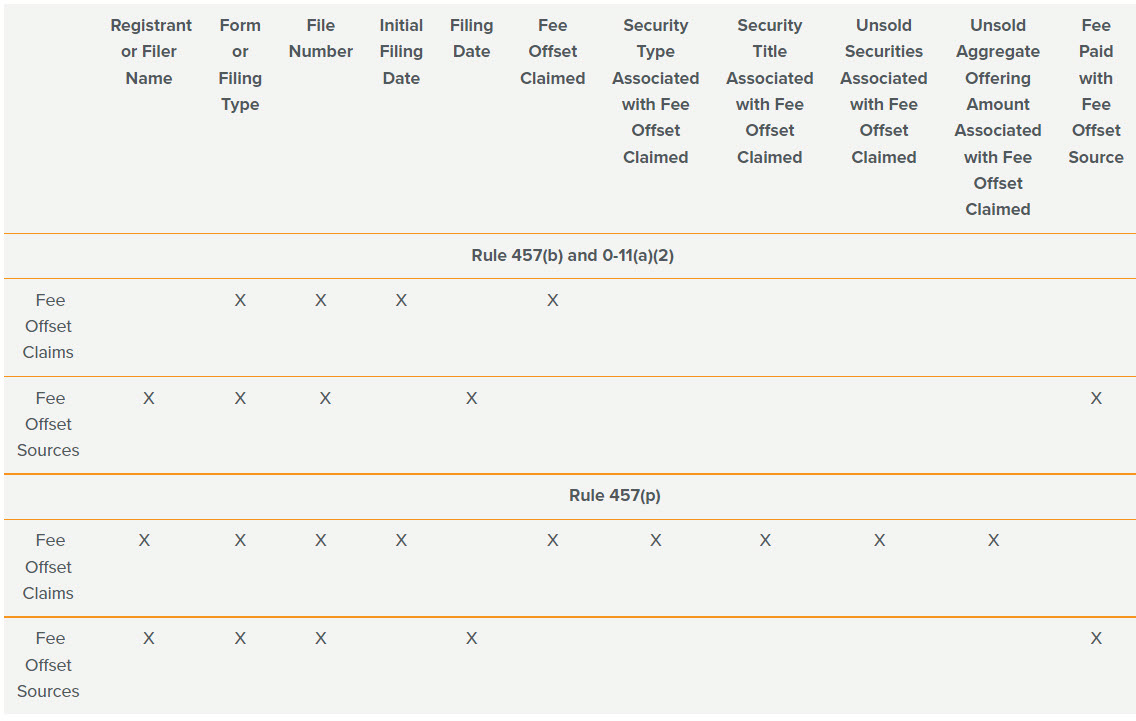

Fee Table Exhibits. The amendments implement a system of filing fee tables that will be filed as exhibits, replacing the filing fee table and information on the cover page and in the EDGAR submission header of most SEC fee-bearing filings. The new exhibit requirement and the related instructions are set forth in Item 601(b)(107) of Regulation S-K and the relevant SEC forms and schedules. The amendments to Form S-1 and Form S-3, for example, include three tables. “Table 1: Newly Registered and Carry Forward Securities,” applies to all Form S-1 and Form S-3 filings. If applicable, these filings should also include “Table 2: Fee Offset Claims and Sources,” which provides information about fee offsets applied to the filing fee, and “Table 3: Combined Prospectuses,” which provides additional information for filings that rely on Rule 429. Blank forms of Table 1 and Table 2 for Form S-1 filings are shown at the end of this alert. The fee table exhibits and amendments to SEC forms and schedules vary somewhat, depending on the form or schedule being filed. The fee table exhibit and related form and schedule amendments became effective on January 31, 2022.

XBRL Tagging Requirement. The amendments will require companies to file the fee calculation information in “structured” format, meaning that the data must be tagged using Inline XBRL as required by Item 408 of Regulation S-T. Large accelerated filers must comply with this requirement for filings made on or after July 31, 2024. All other filers must comply this requirement for filings made on or after July 31, 2025.

Accepted Fee Payment Methods

The amendments eliminate paper checks and money orders as accepted methods for payment of SEC filing fees. The SEC will continue to accept payment of filing fees by wire transfer. In addition to wire transfers, the amendments permit companies to pay filing fees by ACH transfers and by debit or credit cards issued by U.S. financial institutions, subject to certain limitations. The fee payment method amendments will be effective on May 31, 2022.

Filers should be aware that none of these payment methods is instantaneous, and filing fees are not considered paid until the SEC has received the funds. Because some fee payment methods may result in delays of up to three business days in payment of filing fees, the SEC advises in the adopting release that “filers should time their payments and filings accordingly.” Timing considerations for fee payments include the following:

- Wire transfers are generally (but not always) available on a same-business-day basis, but companies incur fees for wire transfers;

- ACH transfers may be made through the banking system or through the U.S. Treasury’s Pay.gov system. Domestic ACH transfers involving amounts of $100,000 or less are eligible for same-day settlement if made through the banking system, but companies incur fees for these ACH transfers. Pay.gov will not require processing fees for ACH payments, but ACH transfers through Pay.gov are expected to require one to three business days for settlement and availability to the SEC for filing fee payments; and

- The SEC expects that debit card payments will not be available until the next business day. The SEC expects that credit card payments may take up to 24 hours following the transaction to be available. Pay.gov is not expected to charge fees for processing debit card and credit card payments, but issuers of debit cards and credit cards may charge fees on these transactions. Pay.gov currently supports Visa and MasterCard debit cards and Visa, MasterCard, American express and Discover-branded credit cards that have been issued by a U.S. financial institution. Credit card payments will be subject to a daily and per-filing-fee limit of $25,000.

Filing Fee Offsets

The amendments change certain fee offset rules and include a new table that provides additional information about fee offset sources, uses and calculations.

The most substantive change permits a company that wishes to increase the registered amount of one or more classes of securities on a registration statement and decrease the amount registered of one or more other classes on the same registration statement to file a pre-effective amendment that calculates the total filing fee due based on the then-current expected offering amounts, offering prices, and filing fee rates and rely on Rule 457(b) to apply the amounts previously paid in connection with the registration statement as a credit against the current total filing fee due, provided that the company did not rely on Rule 457(o) to calculate the original filing fee. This filing fee offset procedure is available only if the company concurrently seeks to increase the amount of one or more classes or add one or more classes and decrease the amount of one or more other classes, but will not be available in situations where a company seeks only to decrease or only to increase the amount of any class of registered securities, or only to add a class of securities to the registration statement.

The amendments also clarify, consolidate and conform a variety of rules and instructions related to filing fee offsets and other filing fee matters. This includes Rule 415(a)(6) and related instructions in Form S-3, which permits companies to carry forward previously registered but unsold securities to a new registration statement, and to apply the filing fee previously paid for the unsold securities to the new registration statement.

Sample Fee Tables: Table 1 and Table 2 (Form S-1)

Item 601(b)(107) sets forth the requirements and instructions for the new fee table exhibits, which are specific to individual forms and schedules. The SEC also amended the relevant forms and schedules. The following examples show the tables for newly registered and carry forward securities (Table 1) and filing fee offset claims and sources (Table 2) for a Form S-1 registration statement.

Table 1: Newly Registered and Carry Forward Securities (Form S-1)

Table 2: Fee Offset Claims and Sources (Form S-1)

Contacts

- /en/people/n/newell-john

John O. Newell

Counsel - /en/people/h/hammons-jim

James H. Hammons Jr.

Knowledge & Innovation LawyerCounsel - /en/people/k/kaufman-jacqueline

Jacqueline R. Kaufman

Counsel