For a PDF of the full article text, click here.

As we head into the heart of the 2017 annual meeting season, corporate governance for public REITs continues to be front and center. This is true not only of those companies that have faced or are facing activist campaigns or other perceived threats, but of all REITs, large and small, across all sectors. Virtually every industry conference and seminar in recent years has included a discussion of corporate governance and REIT investors – whether dedicated, income-based, index oriented or otherwise – are increasingly sensitive to corporate governance developments. Investors have also become more vocal about their governance preferences, both in direct conversation with management and at the ballot box.

Not surprisingly, public REITs have listened and heard. The current crop of REIT proxy statements present detailed and thoughtful discussions on corporate governance, board composition and other relevant policies, often accompanied by prominently placed graphics and charts highlighting stockholder-friendly policies and practices that have been adopted. And it is not just window dressing. We do not sense an equilibrium that is out of balance; rather, we detect a trend of greater direct stockholder engagement that is here to stay. Governance in the public REIT sector, as in corporate America generally, has and will continue to evolve.

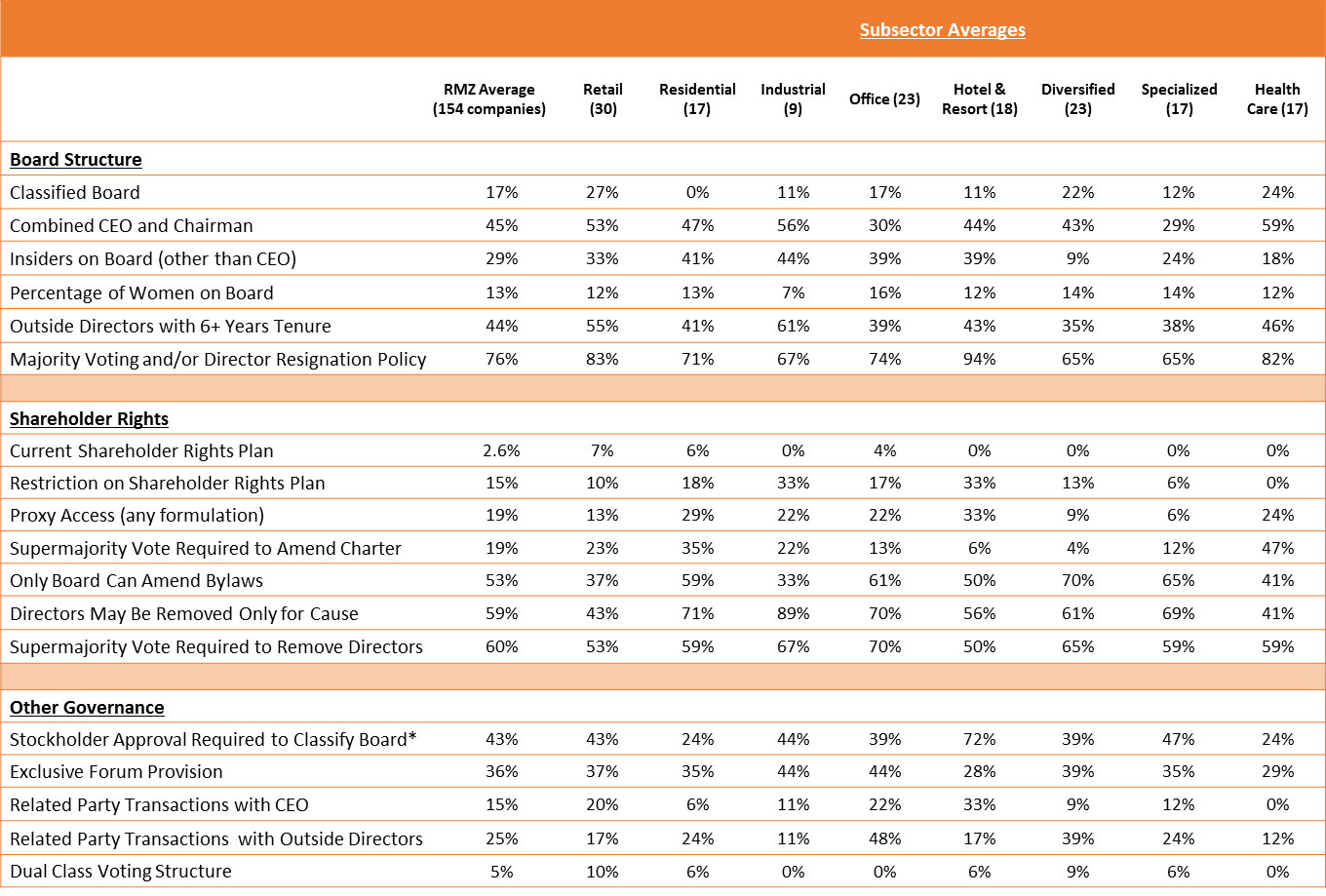

Over the past 3-5 years, large numbers of REITs have adopted, and continue to adopt, important governance enhancements. At the beginning of 2017, for example, over 75% of all public equity REITs had adopted either majority voting or a director resignation policy for uncontested elections, only 17% of REIT boards were classified and only 2.6% maintained an active shareholder rights plan (or “poison pill”). By contrast, 74% of the companies making up the Russell 2000 Index still elected directors by pure plurality voting at the beginning of 2016, a full 45% of index members still had classified boards[1] and nearly 6% currently maintain an active shareholder rights plan.[2]

And, candidly, there are governance areas where the MSCI US REIT Index (RMZ) as a whole diverges somewhat from much larger-cap indices. For example, at the beginning of 2017 only 8% of S&P 500 companies still had classified boards.[3] Moreover, a majority of REITs incorporated in Maryland retain the ability to unilaterally classify their boards under the Maryland Unsolicited Takeover Act (MUTA).

We have had numerous occasions in recent years to emphasize that, in our view, corporate governance is not a “one-size-fits-all” proposition. See for example our REIT Alert “Barbarians at the (REIT) Gates: REITs Should Be Prepared for a New World Order of Shareholder Activists, Hostile Overtures and Proxy Fights,” which discusses a variety of approaches to REIT corporate governance. Likewise, we do not recommend any particular set or subset of governance positions as a blunt instrument approach for all public REITs. Rather, we recommend that the board of each public REIT regularly evaluate the company’s corporate governance profile in light of all relevant facts and circumstances to determine whether the profile is one that provides the board, in its business judgment, with the tools and flexibility to fulfill its overarching duty to maximize stockholder value over the long term. Not all REITs of all sizes, across all sectors and in all circumstances, will best serve their stockholders by making identical choices in corporate governance. For example, while one REIT board may reasonably determine to retain its ability to employ certain takeover defenses in the face of an unsolicited coercive bid given a particular set of facts and circumstances, where the circumstances are different we have not hesitated to advise other REITs to consider affirmatively limiting the defensive tools that might otherwise be available to their boards (e.g., opting out of MUTA or implementing a restriction on the adoption of a “poison pill” without stockholder approval, etc.).

Select Corporate Governance Data Across the REIT Sector

To provide some color and context to REIT boards when undertaking this evaluation, in the table below we have listed an array of corporate governance metrics currently in use, under consideration and/or being monitored in the public REIT market today. All of these metrics are evaluated or noted in one form or another by Institutional Investor Services Inc. (ISS) in formulating its proprietary “QualityScore”.[4] We have reviewed data on these metrics as of March 1, 2017, for each of the 154 REITs currently included in the MSCI US REIT Index (RMZ), and further subdivided the data by sub-industry as classified by the RMZ. In each row below, we show the percentage of REITs, both overall and by sub-industry, which have or have not adopted the relevant governance metric. Brief commentary on each metric follows the table.

* includes Maryland and non-Maryland REITs

Classified Board. One of the most potent anti-takeover devices, directors on a classified board are typically divided into three classes, only one of which is elected each year. This means that even a supermajority of stockholders cannot replace a majority of the board in a single election season. Proponents of classified boards argue that this structure requires fundamental corporate or operational changes to be deliberate and thoroughly vetted rather than rushed through at the expense of long term value.

Combined CEO and Chairman. While nearly half of all REITs believe the company’s chief executive officer is also best positioned to serve as chairman of the board, a slight majority of REITs have elected to separate those roles. Among those REITs that have not separated the roles, a large majority designate an independent director on the board as the “lead independent director” who, among other things, sets the agenda for and leads executive sessions of the independent directors. Stockholders are typically willing to support the combination of the chief executive officer and chairman roles where a lead independent director with sufficiently broad responsibilities has been selected.

Insiders on Board (other than CEO). Some corporate governance watchers discourage populating a board with anyone other than independent directors. Others believe that adding insider voices to overall board discussion can be beneficial. Almost a third of all REITs have at least one insider on the board in addition to the CEO; investors have generally been supportive, particularly when they have confidence in the independent directors on the board to maintain the right course.

Percentage of Women on Board. Diversity in the boardroom rightfully continues to be a focus across industries and sectors, including among public REITs.

Outside Directors with 6+ Years Tenure. Board refreshment is likewise an important current focus in the world of corporate governance. Most commentators believe an optimal board is composed of a mix of directors with long-term company experience and new directors bringing a fresh perspective. As a point of reference, in 2016 the average tenure of boards of S&P 500 companies was 8.3 years, with 63% of S&P 500 companies having average tenures between 6 and 10 years.[5]

Majority Voting and/or Director Resignation Policy. Majority voting generally means that a director nominee cannot be elected to the board unless a majority of votes cast are cast in favor of the nominee’s election. Under plurality voting, a nominee receiving a single FOR vote in an uncontested election is elected to the board, despite the fact that a majority of votes cast may have been cast AGAINST the nominee’s election. A director resignation policy (sometimes known as “plurality plus”) requires that a sitting director receiving less than a majority of FOR votes in an uncontested election tender his/her resignation to the board for its consideration.

Current Shareholder Rights Plan. Less prevalent among public REITs, a shareholder rights plan (or “poison pill”) establishes a level of stock ownership (typically 10% or 15%) which a stockholder cannot exceed without incurring significant dilution to its holdings. As we have discussed in detail elsewhere,[6] the organizational documents of almost all REITs already include a mechanism pursuant to which a stockholder whose actual and/or constructive share ownership surpasses stated ownership limits will have its shares automatically transferred to a trust and resold into the public market.

Restriction on Shareholder Rights Plan. A minority of REITs have affirmatively adopted corporate policies or bylaws prohibiting the company from adopting a rights plan without stockholder approval (or imposing an automatic sunset on any plan adopted without stockholder approval that is not subsequently ratified by stockholders).

Proxy Access (any formulation). Proxy access refers to provisions in a company’s bylaws that enable stockholders to use the company’s own proxy materials to nominate up to a specified number of director nominees.

Supermajority Vote Required to Amend Charter. Important corporate governance changes that require an amendment of the company charter may be more difficult to effect if more than a simple majority vote is required.

Stockholders Can Amend Bylaws. Proxy advisory firms have recently focused on the ability of stockholders to directly and unilaterally amend a company’s bylaws. For many REITs incorporated in Maryland, the exclusive right to amend the bylaws is vested in the board of directors. As a point of reference, across all public companies over the past five years, only 14 proposals seeking binding bylaw amendments have been submitted by stockholders, including three or fewer in each of the last four years.[7]

Supermajority Vote Required to Remove Directors. For REITs with this supermajority requirement, the vote of a simple majority would not be sufficient to remove a sitting director.

Stockholder Approval Required to Classify Board. Unless a company has affirmatively opted out of its provisions, the Maryland Unsolicited Takeover Act (“MUTA”) permits Maryland REITs to unilaterally elect to classify their boards, notwithstanding any contrary provision in their charter or bylaws.[8] Of the 120 RMZ-member REITs organized in Maryland, 32 (or approximately 27%) have opted out of MUTA to date. In addition, a further 34 members of the RMZ are organized in jurisdictions other than Maryland and generally may not stagger their boards without stockholder approval.

Exclusive Forum Provision. A sizable minority of REITs have adopted bylaw provisions that require stockholder derivative and similar law suits to be brought in a specific forum, typically the jurisdiction of incorporation. The intent behind these provisions is to ensure that any such litigation be handled as efficiently as possible.

Related-Party Transactions. These are business transactions entered into by a company with its own CEO or other members of its board of directors, including persons or entities affiliated with its CEO or other members of the board.

Dual-Class Voting Structure. A small number of REITs maintain a dual-class voting structure whereby pre-IPO investors or sponsors hold a class of “high vote” stock that commands a disproportionately higher voting power than the class of stock held by the investing public. In most of these situations, the dual-class structure was implemented to permit holders of operating partnership units to vote their full economic interest at the parent REIT level.

Impact of Governance on Performance: Analysis

Looking further at the data set forth above for each constituent member of the RMZ and comparing the governance data to each company’s historical performance, we found that the line between corporate governance and total shareholder return is not a straight one. To state the obvious, the “best” or “blue ribbon” corporate governance practices cannot overcome chronic underperformance on business fundamentals relative to a peer group. Conversely, numerous public REITs have consistently outperformed their peers over the long term, while also consistently scoring on the low end of the various quotients and metrics used by advisory firms to measure corporate governance. In fact, the data appears to show that REITs with higher scores in corporate governance do not, as a rule, outperform their peers with lower scores (or vice-versa) – there are simply too many other factors at play that more directly affect performance.

In studying the relationship between governance and performance, we reviewed correlation data (as calculated by Microsoft Excel’s built-in correlation formula) between the stated governance metrics and performance. To measure performance, we used 5-year annualized total shareholder return (or such shorter period if the REIT has been public for less than 5 years) as reported by Bloomberg. In quantifying governance results, we used the most recent QualityScore assigned to each REIT by ISS[9].[10]

The notion that the REIT market seems to depart from the generally accepted notion that “better corporate governance leads to higher relative valuations and better relative performance” has been previously noted and documented in the scholarly literature.[11] While not all scholars are in agreement, a number of reasons have been posited by academics for this apparent discrepancy, including:

- the regulated environment in which REITs operate (e.g., the obligation to pay out at least 90% of net earnings and operational restrictions), which may serve to limit operational freedom;[12]

- since REITs are highly transparent and the properties in their portfolios are relatively easy to value, there may be less scope for agency problems;[13] and

- investors value strong corporate governance mechanisms less in naturally strong institutional settings (such as the commercial real estate market) as opposed to weak institutional settings where deviations from corporate governance norms can prove more costly to stockholders.

Inflection Points: When the Going Gets Tough

Whatever the explanation for a perceived lack of correlation between governance and performance for public REITs, our view is that a company’s corporate governance profile is still a critical factor – albeit one of many – in making an investment decision. While the correlation data we reviewed reflects total stockholder return over a 5-year period, it does not measure or reflect something that many investors may prize above all else: the ability to influence outcomes at an inflection point that may possibly involve a fundamental corporate transaction.

For example, a REIT with a classified board and plurality voting, which does not afford proxy access to stockholders, nor the right to remove directors without cause, or the right to amend the bylaws – that kind of governance profile may make it more difficult for stockholders to be heard at a time when the company may be facing a strategic crossroads. A board and management team that is insulated from stockholders may be less incentivized to make strategic decisions based solely on maximizing stockholder value over the long term.

On the other hand, a REIT whose directors are all elected annually, has opted out of MUTA and committed to not adopt a stockholder rights plan, has adopted a liberal form of proxy access and the ability of stockholders to directly amend the bylaws, permits the removal of directors without cause and the ability of stockholders to fill vacancies on the board – that kind of governance profile can make it very difficult for the board and management to exercise their good faith fiduciary duties for the benefit of all stockholders (not only those most interested in event-driven volatility), arguably restricting the board’s ability to be thoughtful stewards of long-term stockholder value when it matters most.

Conclusion: The Right Approach

We do not sense that REITs as a whole have over-reacted to the growing chorus of calls to improve corporate governance, nor do we believe that the REIT market governance “equilibrium” is off-kilter. We believe that the right approach in corporate governance is a subjective, case-by-case analysis, rather than a check-the-box comparison of “good” vs. “bad” governance features. At any given time we believe that each REIT board should assess their company’s individual governance profile in light of all facts and circumstances then relevant to that particular sector and particular company. Moreover, since more permissive corporate governance for REITs does not translate automatically into better returns for stockholders, it follows that boards are not necessarily doing their stockholders a favor by chasing higher governance scores, no matter the cost.

We believe that truly good corporate governance is more meaningfully defined by real-world behavior – does the REIT have an engaged and thoughtful board of directors, comprised of persons with relevant and useful experience, who consistently take action with the aim of maximizing stockholder value over the long term? Does the senior management team regularly and meaningfully engage with stockholders? Which and how many boxes on the corporate governance matrix can be checked becomes of secondary importance to these fundamental questions.

In the REIT sector, we believe this is particularly true given the evolving nature of the stockholder base. With the recent elevation of real estate to a “Headline Sector” under the Global Industry Classification Standard (GICS) and the proliferation of REIT exchange-traded funds (ETFs), the typical public REIT’s stockholder base is increasingly large, diverse and fluid. In this environment, stockholders will not always speak with one voice and different groups of stockholders may have different, and even conflicting, interests. For example, retail investors and some institutional funds may be focused on maintaining stable dividends, while other funds may be facing lifecycle events and/or termination dates that cause their focus to be on near-term liquidity. Likewise, passive index funds may have interests that diverge from those of actively managed funds, and certainly from those of short-term activist funds.[14] So while corporate governance must not be misused or abused with the effect of, say, entrenching an underperforming board, a REIT’s stockholders are not necessarily better off with a “cookie-cutter” permissive governance profile that enables one subset of stockholders to effectively hijack the overall value proposition to the detriment of other stockholder groups.

In our view, a corporate governance analysis should be undertaken holistically, with careful consideration not just of each particular metric but on the inter-connectedness of each metric with others and other provisions in the REIT’s organizational documents. It is not enough to say, “MUTA is bad, let’s opt out,” or “ISS likes bylaw amendments by stockholders, let’s opt in” – since either of these, either alone or when used in conjunction with other available governance arrangements — can prove critical in permitting a board acting in good faith to maximize long-term shareholder value. The question should be: for this company, at this particular time, taking into account its long-term strategic objectives, what makes sense in terms of an overall governance profile? And by “makes sense,” we mean that bundle of board rights and stockholders rights that strikes the right balance between owners and managers for that particular REIT, the one that will ultimately inure for the benefit of the long-term value proposition that prompted the REIT’s creation in the first place.

[1] See Governance Trends at Russell 2000 Companies, EY Center for Board Matters, October 2016. https://pdf4pro.com/view/ey-center-for-board-matters-1a395.html

[2] Source: Capital IQ, Inc., a division of Standard & Poor's.

[3] See 2016 Spencer Stuart Board Index available at www.spencerstuart.com/research-and-insight/spencer-stuart-board-index-2016.

[4] ISS’s QualityScore focuses on the “qualitative aspects of governance, including global governance standards and alignment with ISS voting policy”. Companies receive an overall QualityScore and a score for each of ISS’ four “pillars”: Board Structure, Compensation/Remuneration, Shareholder Rights and Audit & Risk Oversight.

[5] 2016 Spencer Stuart Board Index available at www.spencerstuart.com/research-and-insight/spencer-stuart-board-index-2016.

[6] See our REIT Alert, Waivers of Ownership Limitation Provisions in REIT Charters, June 8, 2016.

[7] 2016 Annual Corporate Governance Review, Georgeson, available at http://www.computershare-na.com/sharedweb/georgeson/acgr/acgr2016.pdf.

[8] In addition, MUTA permits public REITs incorporated in Maryland, notwithstanding any contrary provision in their charter or bylaws, to (i) require a two-thirds super-majority vote requirement for removing a director; (ii) require that the number of directors be fixed only by vote of the directors; (iii) require that a vacancy on the board be filled only by the remaining directors; and (iv) require that no less than a majority of stockholders may call a special meeting of stockholders. Most REITs organized in Maryland have opted out of the state’s other two primary anti-takeover statutes, the “business combination” and “control share acquisition” provisions of the Maryland General Corporation Law.

[9] We used the most recent QualityScore assigned by ISS to each REIT, rather than a form of trailing 5-year average, to ensure that the governance scores were “apples to apples” as applied to each company. We appreciate that this may impact correlation data for those REITs whose corporate governance scores have changed significantly during the sample period.

[10] ISS’ determination of its QualityScore for each REIT includes ISS’ evaluation of executive compensation. To ensure that the compensation component of the QualityScore was not disproportionately affecting the results of the correlation analysis, we also completed scoring for each REIT based solely on the 18 corporate governance metrics discussed above in the table (which do not include executive compensation). We found that the correlation results were substantially similar as between ISS’ QualityScore and the pure-corporate governance scoring.

[11] See, e.g., Bianco, C., C. Ghosh and C.F. Sirmans. 2007, The Impact of Corporate Governance on the Performance of REITs, Journal of Portfolio Management 33: 175–191; Bauer, R., Eicholtz, P. and Kok, N., 2010, Corporate Governance and Performance: The REIT Effect, Real Estate Economics, Volume 38, Issue 1, pages 1–29.

[12] For example, Bauer, Eicholz and Kok, 2010, found that the relationship between governance and performance increased in the subsample of REITs that had relatively low payout ratios and therefore large discretionary cash flows.

[13] In the context of public companies with a much lower percentage of fixed assets (e.g., technology companies), we note the recent statement from FTSE Russell to the effect that it plans to consult with investors and other stakeholders over the next few months about whether to include in its indices companies whose publicly held shares have no voting rights. https://www.wsj.com/articles/index-firms-take-issue-with-nonvoting-rights-1491739227.

[14] See, e.g., interview of Jonathan Litt, founder and chief investment officer at Land and Buildings, a REIT-dedicated activist fund, held in conjunction with REITWise 2017: NAREIT’s Law, Accounting & Finance Conference in La Quinta, California. https://www.reit.com/news/videos/litt-says-activist-investors-interested-more-short-term-returns). In describing Land and Building’s activist strategy of working to maximize value over the long term, Mr. Litt notes that there are “short-term ways to make money which are not the best outcome for all shareholders”.

Contacts

- /en/people/k/kranz-yoel

Yoel Kranz

PartnerCo-Chair of REITs and Real Estate M&A - /en/people/h/haggerty-john

John T. Haggerty

Partner - /en/people/m/menna-gilbert

Gilbert G. Menna

Of Counsel - /en/people/a/adams-daniel

Daniel P. Adams

Retired Partner - /en/people/s/santucci-ettore

Ettore A. Santucci

PartnerCo-Chair of Debt Capital Markets, Co-Chair of REITs and Real Estate M&A