PropTech – the convergence of real estate and technology – has effectively transitioned from disrupting the well-established real estate industry with trending tech to a burgeoning sector of start-ups and forward-looking real estate players introducing innovations that are quickly transforming the real estate marketplace. Driven by a few key dynamics, the PropTech industry appears on the verge of a wave of consolidation that will usher the next stage of evolution for the industry.

Over the last several years, funding into the PropTech industry has been on a steady rise. From 2015 through 2018, global venture capital investment in the real estate technology sector, including by real estate funds and traditional venture capital investors, has plotted a upward trajectory: $1.8 billion in 2015, $4.2 billion in 2016, $12.6 billion in 2017 and $11.2 in 2018 (Source: CRETech). The resulting number of PropTech assets spawned by this capital infusion has set the stage for consolidation within the industry.

In addition, while real estate has historically been a delayed participant in technological innovation, a new generation of real estate entrepreneurs is bringing a better understanding of the opportunity for growth in net operating income associated with the adoption of technology. The combination of the digitalization of real estate and the increase in funding specifically devoted to PropTech investments from angel investors, venture capital and well-capitalized and well-established real estate investors, is driving and will continue to drive an active PropTech M&A pipeline.

Competition for Funding and Achieving Scale through Tech/Tech M&A

As fundraising has become increasingly competitive due to the acceleration of the number of PropTech assets in the market, small and midsized startups are combining to build more valuable and attractive real estate technology platforms. These technology-to-technology company consolidations position the combined platforms with an enhanced opportunity for new investment, combine funding from existing investments and increase the potential for utilization within real estate firms because of enhanced scale.

Adoption of tech within real estate, however, still faces adversity for several reasons: (1) a desire for access to more cohesive tech solutions with capacity to address various gaps in services, (2) concerns that there is a lack of internal expertise within real estate firms to effectively evaluate the numerous single-offering tech solutions available in the market and (3) the view among many real estate operators that tech developers lack sufficient knowledge of real estate to develop applications that will be effective in integration across a real estate business model and that tech startups have simply crowded the space due to the uptick in funding.

As a result while many real estate companies recognize the potential of technological innovation, actual adoption of solutions must confront these identified hurdles around the ease, efficiency and potential success of adoption. The consolidation of smaller tech companies has yielded solutions with enhanced scale, which in turn, has made real estate companies more willing to take the risk of incorporating new technologies into their business model.

The VTS merger with Hightower, a $300 million combination of two cloud-based leasing and portfolio management data platforms, exemplifies the benefits that can be realized in PropTech M&A, including increased market share and efficiencies from cost-savings. On a stand-alone basis, the two companies would have continued to compete for the same customer base while offering less functionality across their respective data offerings. The merger created a combined company with a more valuable product. The synergies resulting from the deal included customer base growth of more than 28,000 real estate users and portfolio growth of more than 7 billion square feet, increases of 87% and 112%, respectively, to the pre-merger stand-alone company comparatives. Also combining each company’s key investor bases, including Blackstone, OpenView, Bessemer Venture Partners and Thrive Capital, resulted in more access to capital.

The following table reflects transaction profiles of additional tech/tech combinations in the PropTech industry from 2015 to today, demonstrating the surge of recent transactions in the space:

| Aquiror | Target | Year | Valuation |

Segment |

| States Title |

Captive Title North America |

2019 |

Undisclosed |

Title company analytics platform |

| Amazon |

Eero |

2019 | Undisclosed |

Tech e-commerce |

| News Corp |

OpCity |

2018 |

$210M |

Broker/buyer intermediary |

| RealPage |

ClickPay | 2018 |

$219M |

Property management and payment platform |

| Siemens |

Comfy |

2018 |

Undisclosed |

Smart buildings |

| Autodesk |

PlanGrid |

2018 |

$875M |

Construction productivity software |

| Knotel |

42 Floors |

2018 |

$10.35M |

Office leasing data and technology |

| RealPage |

Rentlytics |

2018 |

$57M |

Real-time leasing data analytics |

| RealPage |

LeaseLabs |

2018 |

$117M |

Go direct marketing suite |

| RealPage |

On-Site |

2017 |

$250M |

Lease and property management integration |

| CoreLogic |

Mercury Network |

2017 |

$153M |

Data analytics and valuation technology management |

| RealPage |

Lease Rent Options |

2017 |

$300M |

Property and revenue software platform |

| Oracle |

Aconex |

2017 |

$1.2B |

Cloud software construction platform |

| View the Space |

Hightower |

2016 |

$300M |

Cloud based leasing and portfolio data |

| Zumper |

Padmapper |

2016 |

$10M |

Residential search platform |

| Ritchie Brothers |

Iron Planet |

2016 |

$785.5M |

Platform to buy, list, sell construction equipment |

| Roper Technologies |

ConstructConnect |

2016 |

$632M |

Integrated applications and project information |

| Oracle |

Textura |

2016 |

$663M |

Cloud software construction platform |

| Expedia |

HomeAway | 2015 |

$3.9B |

Hospitality |

| AltiSource Portfolio Solutions |

Rentrange |

2015 |

Undisclosed |

Market intelligence platform |

| AltiSource Portfolio Solutions |

Investability |

2015 |

Undisclosed |

Mortgage data platform |

| Zillow |

Dotloop |

2015 |

$108M |

Online database and e-signing service |

| Zillow |

Trulia |

2015 |

$3.5B |

Online real estate database |

Stage Two: Real Estate/Technology Company Combinations

The consolidation of small PropTech technology companies coupled with the fact that certain real estate sectors like hospitality, retail, office, residential and industrial, are well-positioned for technological transformations aimed at correcting operational inefficiencies, is expected to result in a second tier of real estate/tech combinations.

For those companies where implementation of uniform technology across the portfolio yields operational and economic advantages, acquisitions of mission-critical tech assets – in lieu of recurring licensing – will provide ownership of and immediate and ongoing use of the technology. The associated cost-savings, together with the bottom line operational efficiency savings may be the more long-term economically efficient model for certain real estate businesses.

The recent CBRE acquisition of Floored illustrates the benefits of real estate/tech M&A. As a real estate management firm, CBRE routinely builds and reconfigures commercial properties to meet the specifications of investors or incoming tenants. Floored is a software-as-a-service company focused on interactive 3D technology which facilitates floor plan editing and simulations of walk-through experience similar to Google Maps. Floored provides CBRE with the ability as it develops and remodels properties to offer clients views of the built-out projected property. Other real estate powerhouses like Equity Office, Hines and Beacon Capital use similar technologies.

In addition, and while not directly a PropTech industry transaction, Prologis’ acquisition of DCT Industrial has cross real estate/tech implications as the combination was aimed at capitalizing on the high growth in e-commerce. The Prologis-DCT transaction resulted in a combined 71 million-square-foot U.S. portfolio of valuable industrial distribution centers servicing the distribution and delivery of products through the growing e-commerce channel. Similarly, Brookfield’s acquisition of GGP was driven in part by a desire to capitalize on the opportunity to transform GGP’s retail assets in a period during which the retail real estate sector is being reshaped by technology and e-commerce.

The following table reflects transaction profiles of additional real estate M&A transactions with technology industry targets and/or technology-based drivers, from 2014 to today:

| Acquiror | Target | Year | Valuation | Segment |

| Prologis |

DTC Industrial |

2018 |

$8.5B |

Industrial / e-commerce |

| Sumitomo Forestry |

Crescent Communities |

2018 |

$370M |

Smart building technology |

| JLL Spark |

Stessa |

2018 |

Undisclosed |

SaaS technology |

| Brookfield |

GGP |

2018 |

$15B |

Retail |

| CoStar Group |

ForRent |

2017 |

$385M |

Tech-based multifamily information platform |

| Berkadia |

RedIQ |

2017 |

Undisclosed |

Data (Multifamily) |

| Industrious |

Pivotdesk |

2017 |

Undisclosed |

Digital platform for flex office space |

| CBRE Group, Inc. |

Floored Inc. |

2017 |

Undisclosed |

Interactive tech-based leasing |

| AccorHotels |

Onefinestay |

2016 |

$167M |

Hospitality |

| CoStar Group |

Network Communications |

2015 |

$172M |

CRE analytics and lead generation |

| Move, Inc. |

News Corporation |

2014 |

$950M |

Residential rental search platform |

| Realogy Group LLC |

ZipRealty, Inc. |

2014 |

$165.7M |

Online residential brokerage operation |

| CoStar Group |

Apartments.com |

2014 |

$585M |

CRE analytics and online rental marketplace |

Conclusions

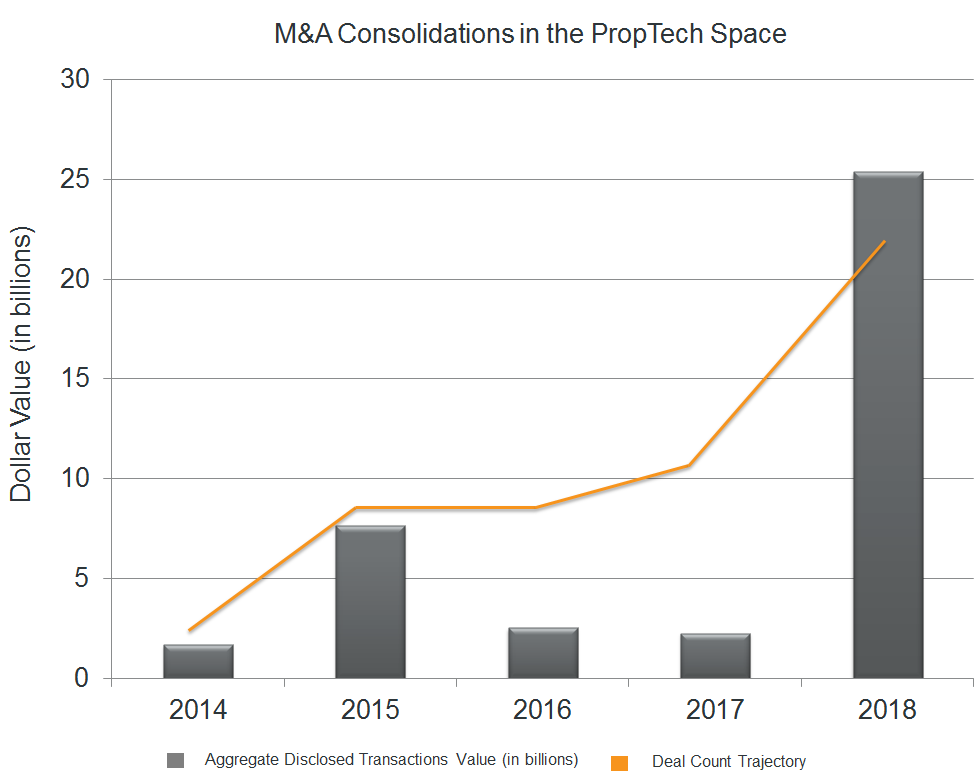

The following table reflects PropTech combinations by deal count and aggregate deal value per year, from 2014 to 2018, reflecting the upward overall trending of such transactions.

Source: CapitalIQ

As the real estate industry moves to embrace technological innovation, one of the main challenges to tech integration is the fragmentation of PropTech assets into small scale early stage offerings of specialized technology. The consolidation of these assets has both reduced the competition that they face for funding and the resulting increase in scale optimizes the likelihood of attention from real estate incumbents attracted to the possibility of a single platform provider for all technology needs. Taken together, these factors are driving the rise of deals and pace of PropTech M&A, which we expect will continue in 2019 and beyond, including both tech/tech consolidation and real estate/tech acquisitions.

During Goodwin’s 2019 Real Estate Capital Markets Conference, partner Blake Liggio shared his views on M&A in PropTech and what led him to join the firm’s PropTech practice.