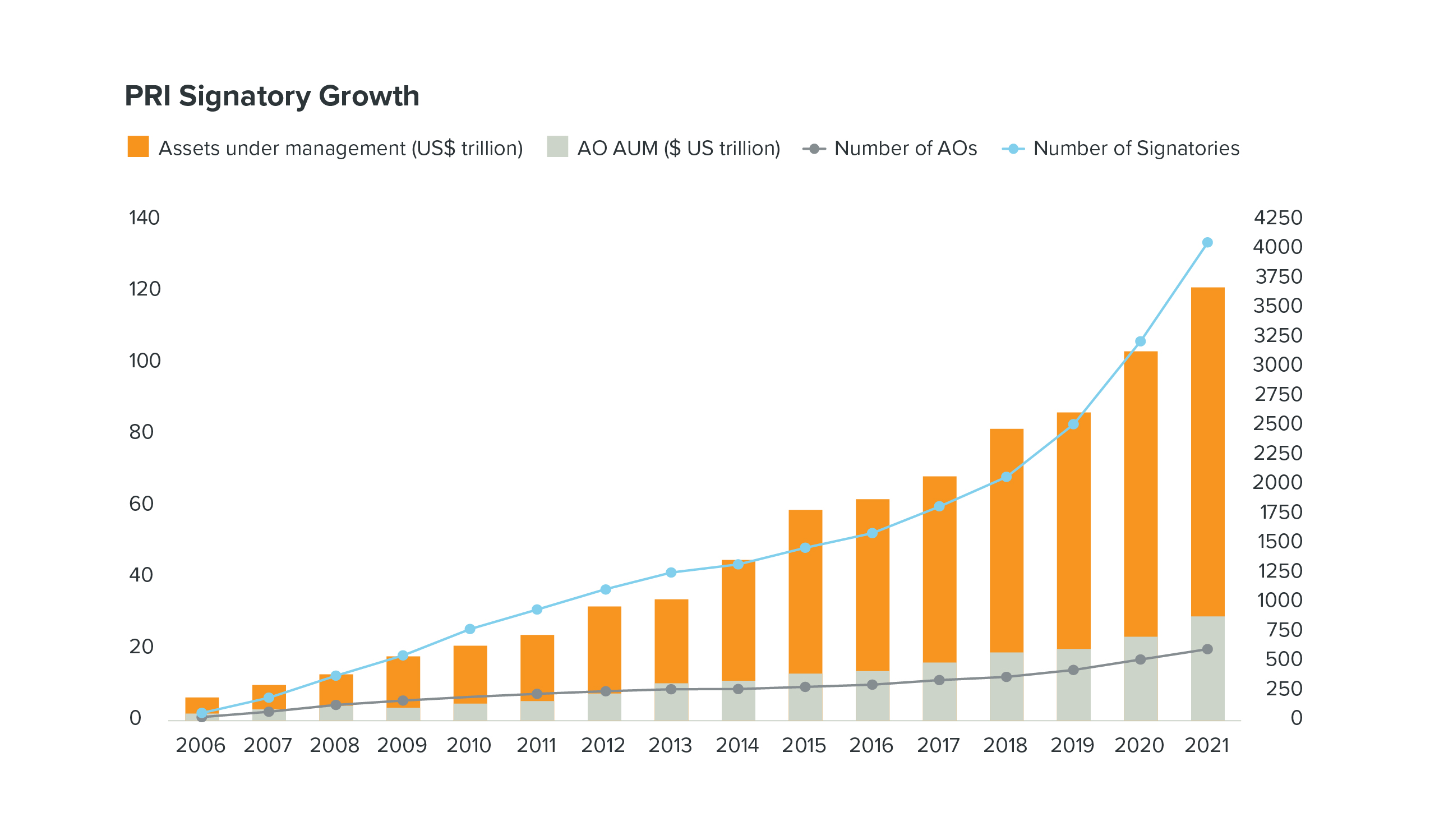

Global flows of private capital into sustainable investment strategies continued to gain momentum in 2021. Over 3,826 investor signatories committed to the UN Principles for Responsible Investment in 2021, equating to a 65% increase in membership since 2015. These signatories represent approximately $150 trillion of Assets Under Management, a 52% increase since 2015.1

To view a larger version of this graph, please click here.

Drivers of sustainable investing strategies

The importance of sustainable investment and ESG value creation was magnified by a myriad of factors in 2021, including concerns regarding societal inequities exposed by COVID-19, continued and increasing focus on environmental impacts and global commitments to reduce carbon emissions at COP 26, regulatory developments in Europe such as the adoption of Sustainable Finance Disclosure Regulation, and the growing primacy given to ESG due diligence by capital allocators.

Capital Allocators Commitments to ESG Integration

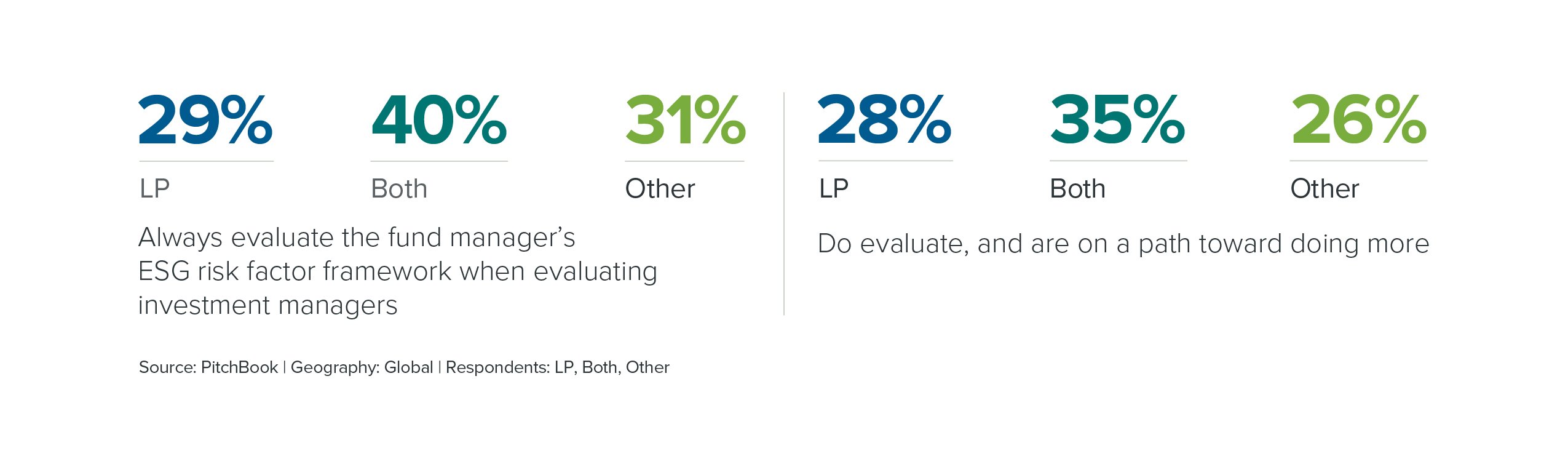

When asked whether capital allocators considered a GP’s ESG risk factor framework as part of their due diligence processes, 29% of direct LPs and 40% of fund-of-fund LPs confirmed they always do so, and 28% and 35% respectively said they “do make ESG evaluations, and are also on a path toward doing more”.2

To view a larger version of this graph, please click here.

Challenges of ESG Monitoring and Reporting

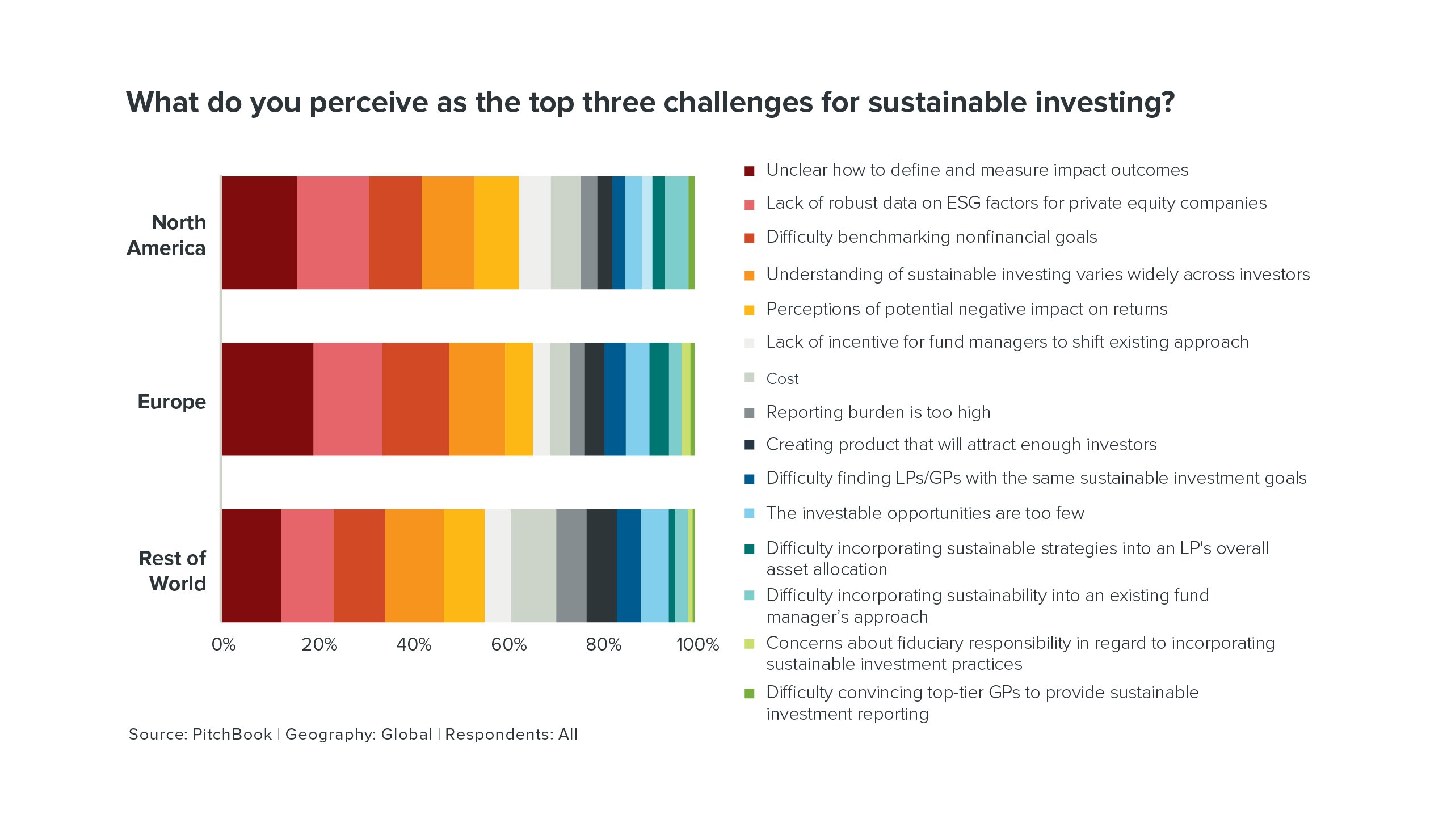

However, despite growing commitment to the integration of ESG into investment decision-making, both GPs and LPs have identified (1) the lack of robust and consistent data on ESG factors for private companies and (2) the difficulty in benchmarking non-financial goals among their top, ongoing challenges for sustainable investing.

To view a larger version of this graph, click here

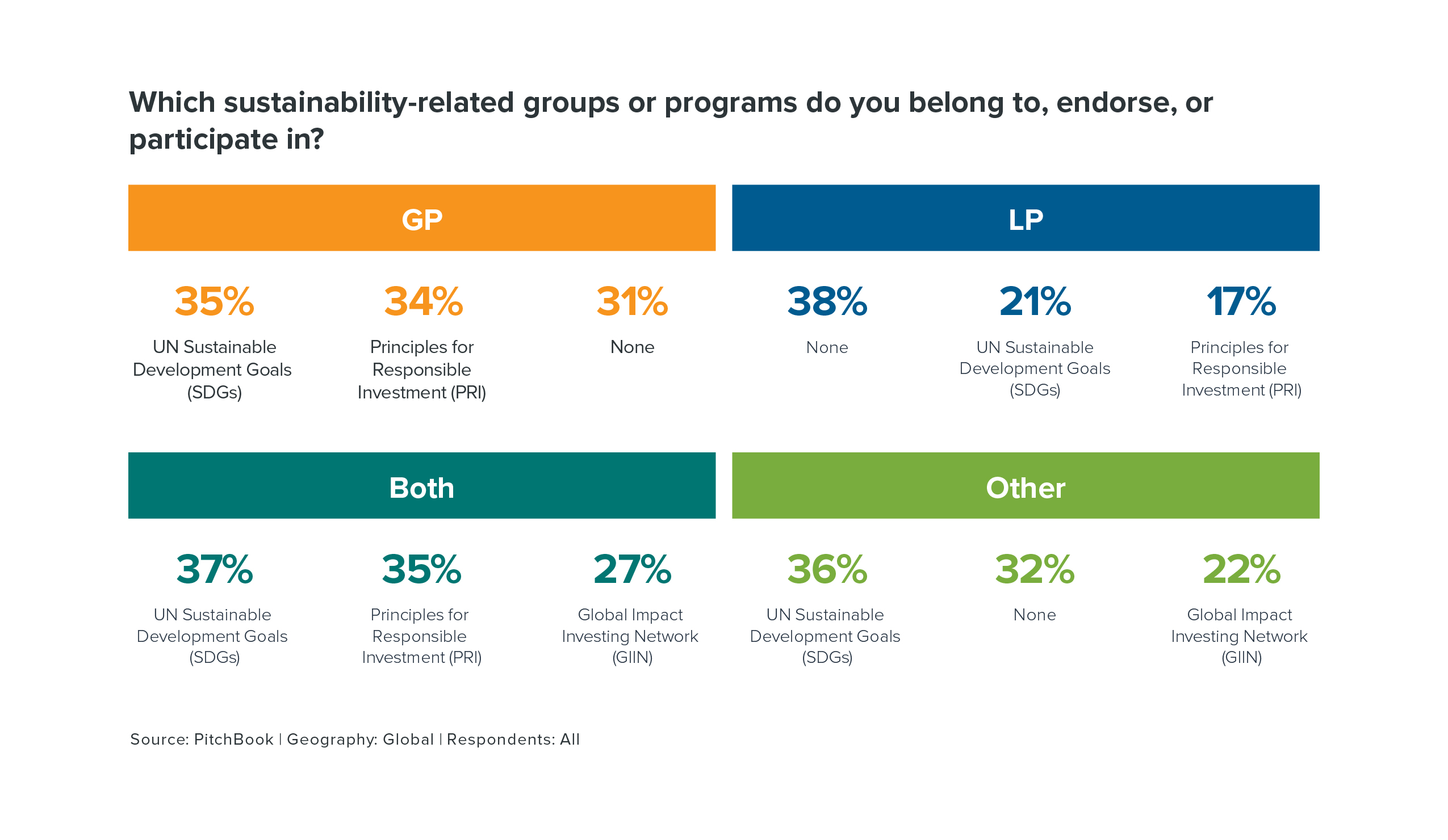

Specifically, identifying, measuring and reporting material ESG risks has been complicated by the proliferation of reporting standards (e.g. SASB, GRI, TCFD, UN SDGs, PRI, GIIN, CDP), which each bring their own unique value proposition and suitability for different stakeholders. When surveyed as to which sustainability-related groups/programs LPs/GPs participated in, there was no clear front-runner among these reporting frameworks.3 While there has been some streamlining of frameworks through recent collaborations to “mainstream the practice of impact management4”, there is no single framework to track ESG performance across portfolio companies – and therefore across funds – thereby highlighting the need for a more standardized ESG reporting framework for the private equity industry.

To view a larger version of this graph, click here

Data Convergence for the Private Equity Industry

For the first time, a number of global LPs and GPs (representing more than $4 trillion in AUM) have partnered to create the ESG Data Convergence Project hosted by ILPA (“Convergence Project”), with the aim of “streamlining the private equity industry’s historically fragmented approach to collecting and reporting ESG data in order to create a critical mass of meaningful, performance-based, comparable ESG data from private companies.5”

The industry collaboration was led by CalPERS and Carlyle, participating LPs include AlpInvest Partners, APG, CalPERS, CPP Investments, Employees’ Retirement System of Rhode Island, PGGM, PSP Investments, The Pictet Group, Wellcome Trust; and GPs include: Blackstone, Bridgepoint Group Plc, CVC, EQT, AB, Permira, and TowerBrook.

Core ESG Metrics

The Convergence Project has begun by aligning participants around a core set of six initial ESG metrics to report on, each drawn from existing frameworks:

- Scopes 1 and 2 greenhouse gas emissions (with Scope 3 GHG emissions being optional);

- Renewable energy %;

- Board diversity;

- Work-related injuries;

- Net new hires; and

- Employee engagement6.

The core metrics were selected on the basis that they are each:

- Globally Accepted — selected from the most accepted and widely regarded frameworks; including GRI/WEF, SASB, and TCFD (and EU SFDR as formalized);

- Meaningful —from a financial or societal impact perspective; may be specific to a given industry;

- Comparable — allows performance comparisons between Portfolio Companys /GPs; adequate overlap exists across sectors;

- Dynamic — metrics are expected to evolve over time, as tracking gets better and understanding evolves;

- Straightforward — simple to track accurately, with limited total number of metrics to not overburden companies and ensure data quality and integrity;

- Actionable — tied to specific actions that GPs and portfolio companies can control;

- Objective should minimize subjectivity or need for interpretation7.

Key Developments

One of the key developments introduced by the Convergence Project pertains to the reporting process. Reporting and transmission of ESG data by private equity GPs to their LPs currently takes place directly between the two parties. However, GPs participating in the Convergence Project will also provide their data on the 6 core ESG metrics to Boston Consulting Group (BCG), who will act as an independent third party aggregator. BCG will aggregate collected data into a benchmark, which will be available to any participating LP regardless of whether they are invested in a constituent fund.8

Although 2021 is the first official year of ESG data collection for the Convergence Project, a pilot was previously completed based on historic data. GPs provided BCG with data from 2018 to 2020 across a group of nearly 100 portfolio companies, 18 countries, and approximately 40 industries. According to BCG, the exercise surfaced several useful insights regarding the progress PE-owned companies are making toward their ESG goals, and how their progress compares to public companies. For example, the percentage of portfolio companies reporting their emissions increased from 1% in 2018 to 61% in 2020.

Implementation of the Convergence Project

The Reporting Handbook provides guidance in relation to a number of key topics:

Data Collection: GPs will collect data annually which is to be submitted through an excel reporting template provided on the ILPA website, with company level data anonymized. BCG will act as a master aggregator to create suitable benchmarks if enough data exists to ensure that no single portfolio company or fund can be extrapolated from the data.

Data Validation, Analysis and Insight will be produced by BCG, with responsibility for data quality remaining with each GP.

Fund Participation: GPs will initially select which funds will report 2021 calendar year data, with the expectation that over time GPs will try to increase the number of funds reporting yearly data.

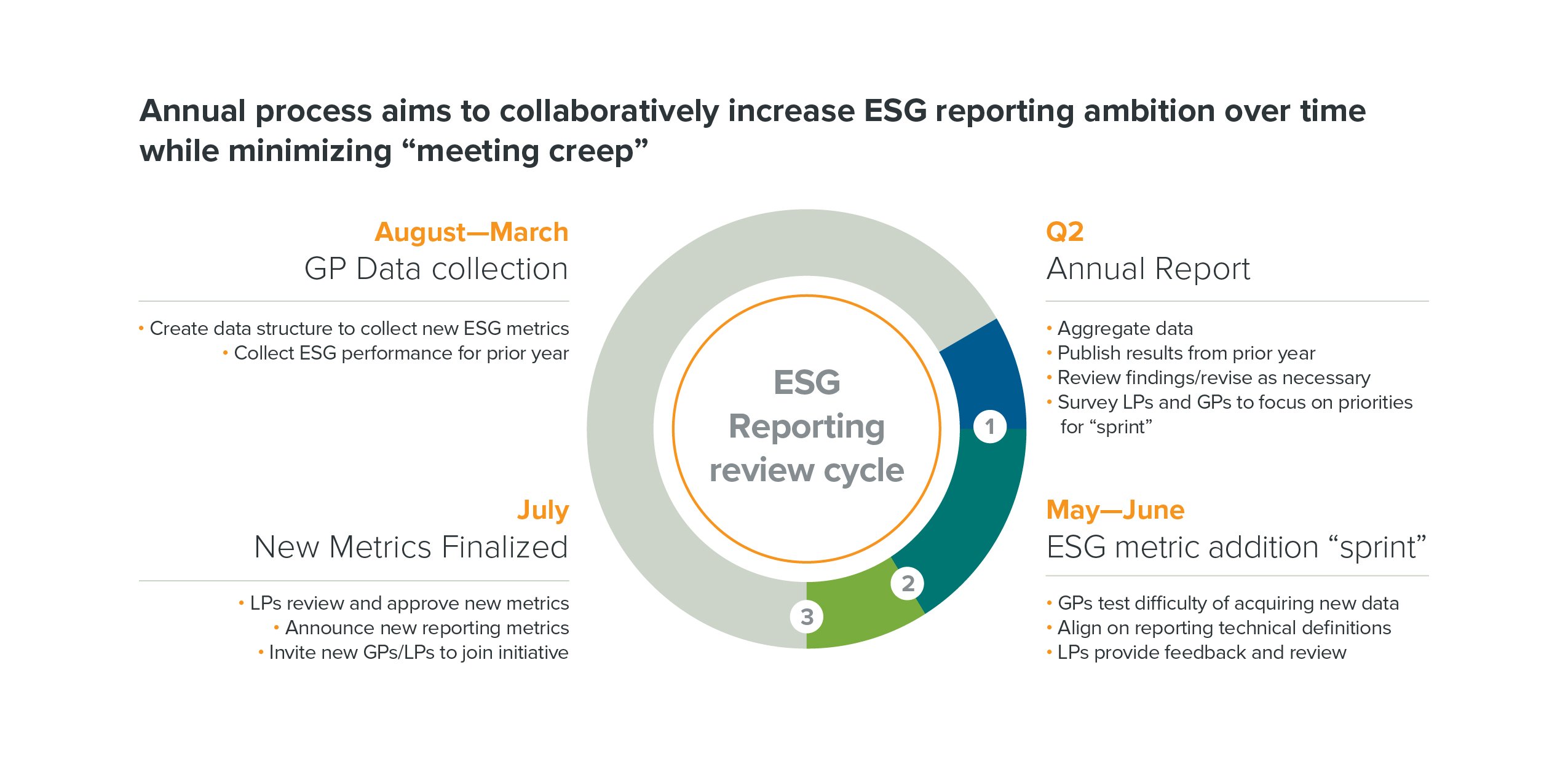

Metrics: Company-level details will be used to normalize and segment the data; several new KPIs/metrics may be added each year if passed by majority vote of all GPs and LPs (finalization is due to take place annually in July).

Reporting Timetable

The key dates to reporting and finalization have been set out in the timetable below, provided in the Convergence Project summary presentation.

To view a larger version of this graph, please click here.

Participation

The partnership is open to any GPs and LPs that wish to join and agree to support the principles of the work.

If you would like further information on the Data Convergence Project specifically – or on ESG matters more generally – please contact Rajal Patel at rajalpatel@goodwinlaw.com.

1 Source: PRI

2 Source: PitchBook 2021_ Sustainable_Investment_Survey

3 Source: PitchBook 2021_Sustainable_Investment_Survey

4 The Principles of Responsible Investment and the Value Reporting Foundation, collaborated with the Global Reporting Initiative, OECD and World Benchmarking Alliance on the Impact Management platform (Responsible Investor.com)

5 https://ilpa.org/ilpa_esg_roadmap/esg_data_convergence_project/

6 Source: ESG Data Convergence Project

7 Source: ESG Data Convergence Project

8 Source: https://ilpa.org/wp-content/uploads/2021/09/ESG-Data-Convergence-Project-Summary_29Sept21.pdf

9 https://www.bcg.com/publications/2021/private-equity-convergence-on-esg-data