02022 Trends in ERISA Litigation Concerning Retirement Plans

Key Takeaway: Plaintiffs have continued to bring lawsuits regarding ERISA-governed retirement plans in 2022, which will likely continue to be a hot area of the law in 2023 and beyond. However, in the wake of the Supreme Court’s ruling this year in Hughes v. Northwestern, some Courts of Appeals have scrutinized plaintiffs’ allegations more carefully.

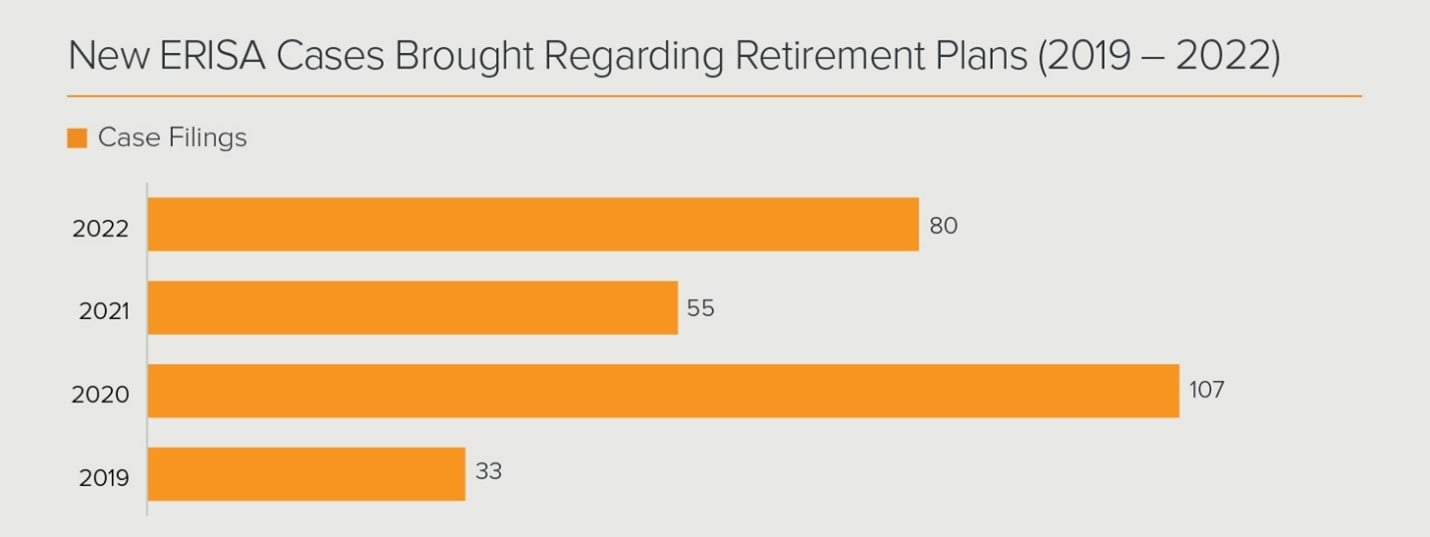

Consistent with recent filing trends, 2022 was another very active year in ERISA litigation concerning retirement plans. The number of cases filed in 2022 concerning retirement plans did not quite reach 2020’s record of over 100 new cases, but at approximately 80 new cases filed, 2022 was the second most active year to date (and up from the approximately 55 cases filed in 2021).

Some notable trends in the ERISA retirement plan litigation space are as follows:

- Impact of the Supreme Court’s Hughes decision: Since the Supreme Court’s ruling in Hughes v. Northwestern (discussed by Goodwin here), federal courts have been fairly split on motions to dismiss and other dispositive motions in ERISA suits. Approximately 24 dispositive motions have been granted (or affirmed on appeal), and approximately 33 dispositive motions have been denied in full or in part (or reversed and denied on appeal).

Several courts that have granted dispositive motions have noted the Supreme Court’s instruction in Hughes that “at times, the circumstances facing an ERISA fiduciary will implicate difficult tradeoffs, and courts must give due regard to the range of reasonable judgments a fiduciary may make based on her experience and expertise.” Others have observed that, even though the Supreme Court ultimately found for the plaintiffs, it was on a narrow issue. Indeed, since Hughes, the Sixth, Seventh, and Eighth Circuit Courts of Appeals have published opinions entirely or mostly affirming dismissals of ERISA suits. Goodwin’s analysis of those opinions are linked to here (Sixth and Seventh Circuit), or contained below (Eighth Circuit). Lower courts in those jurisdictions have followed those rulings; for example, seven of the 24 dismissals in 2022 (or nearly a third) were decided by district courts in the Seventh Circuit.

In denying motions to dismiss, some courts relied on the Supreme Court’s directive that evaluating retirement plan litigation must be “context-specific.” At least in part for that reason, those courts held that allegations that recordkeeping or investment management fees are excessively expensive compared to allegedly cheaper alternatives are sufficient to withstand a motion to dismiss. For example, in Kong v. Trader Joe’s Co., the Ninth Circuit held that the defendants could offer an explanation for more expensive choices at a later stage in the litigation, but the plaintiff’s allegation that the plan improperly selected a more expensive share class was enough to survive a motion to dismiss.

- Settlements continue to be lucrative: 2022 saw 25 settlements totaling more than $132 million. Settlements ranged in amounts from $900,000 to $32.5 million, with four settlements under $1 million, 12 settlements between $1 million and $5.1 million, and four settlements over $10 million. In addition, many cases settled at a relatively early stage, typically during discovery, after a motion to dismiss was denied in whole or in part, but before a motion for summary judgment was filed.

- Lawsuits continue to be brought against sponsors and fiduciaries of smaller plans: The trend of filing suits against smaller plans continued, as many smaller plans were targeted in 2022. Twenty-eight suits—approximately a third of the total suits in 2022—were filed concerning plans with under a billion dollars in assets. Of those 28 suits, 19 concerned plans with under $750 million in assets, 14 concerned plans at or under $500 million, and three concerned plans under $250 million. To be sure, plaintiffs also filed suit against large plans, with 16 cases filed regarding plans with more than $3 billion in assets and five regarding plans with more than $10 billion in assets.

0Eighth Circuit Court of Appeals Affirms Grant of Motion to Dismiss

Key Takeaway: The Eighth Circuit affirmed the dismissal of breach of fiduciary duty claims based largely on the plaintiffs’ failure to plead facts sufficient to demonstrate the appropriateness of their alleged comparators.

On October 17, 2022, the Eighth Circuit Court of Appeals affirmed the district court’s dismissal of a lawsuit against MidAmerican Energy Company. The complaint alleged that the fiduciaries of MidAmerican’s 401(k) retirement plan violated ERISA’s duty of prudence by (i) failing to leverage the size of the plan to reduce recordkeeping fees for participants, and (ii) failing to remove underperforming and/or costly investment options. The District Court for the Southern District of Iowa granted MidAmerican’s motion to dismiss the complaint.

On appeal, the Eighth Circuit affirmed, holding that the plaintiffs failed to allege sufficient facts to support a plausible inference of a breach with respect to either of their two theories. With respect to the plaintiffs’ allegations regarding excessive recordkeeping fees, the court found that plaintiffs had failed to allege that the plan’s recordkeeping fees were greater than those charged to similar plans for the same services. Specifically, the court held that it was not enough for plaintiffs to compare the plan’s fees to industry average fees, absent allegations that the industry average fees reflected fees for the same services and similar plans as the at-issue plan. With respect to plaintiffs’ allegations regarding expensive and underperforming investment options, the court similarly found that plaintiffs failed to adequately allege that the funds to which they compared the at-issue investment options were, in fact, appropriate benchmarks.

The case is Matousek v. MidAmerican Energy Co., No. 21-2749, in the Eighth Circuit Court of Appeals, and is available here.

0District Court Grants Motion to Exclude Hindsight-Based Damages Opinions

Key Takeaway: A district court granted the defendants’ motion to exclude plaintiffs’ expert’s damages opinions, where such opinions were derived from a comparison of the at-issue investments to funds that had above-average performance during the damages period and were selected using data that the plan’s fiduciaries could not have had at the time of the alleged breaches.

On November 1, 2022, the U.S. District Court for the Central District of California granted in part the defendants’ motion to exclude expert opinions in a case alleging that the defendants had breached their fiduciary duties by failing to prudently monitor the plan’s investment options. In support of their claims, the plaintiffs sought to introduce expert testimony that such alleged failures had caused damages to the plan’s participants. That expert calculated the amount of damages by first identifying alternative investment options, and then comparing those options’ performance during the damages period to the performance of the challenged investments. The alternative investment options were selected based in part on their performance after the date of the alleged breaches. The defendants moved to exclude the expert’s opinions under the principles of Daubert v. Merrell Dow Pharmaceuticals, Inc., 509 U.S. 579 (1993).

The district court granted the motion to exclude as to this expert’s opinions. The district court reasoned that damages in ERISA cases cannot be calculated based on comparisons to alternative investment options that were selected using information that the plan’s fiduciaries could not have had at the time of the alleged breaches. As the court explained, such alternative investment options are therefore not plausible alternatives for the plan because their selection is dependent on information that was unavailable to a fiduciary evaluating investment options at the time of the breaches. The district court additionally ruled that this comparison between the at-issue funds and hindsight-based alternatives cannot be used to establish fiduciary breaches.

The case is Munro v. University of Southern California., No. 16-06191, in the Central District of California. The decision is available here.

0Recent Insights

- Article: Department of Labor Finalizes Amendments to Investment Duties Regulation (January 3, 2023)

Goodwin partners Patrick Menasco and Bibek Pandey, and law clerk Benjamin Kurrass, co-authored an article that discussed the U.S. Department of Labor’s final amendments to its regulation on investment duties under Section 404(a) of ERISA.

- Article: Second Circuit Vacates Certification of Nationwide Class in ERISA Lawsuit (December 7, 2022)

Goodwin partners Jamie Fleckner, Michael Isenman, and Jaime Santos, and associate Molly Leiwant, co-authored an article that discussed the victory Goodwin secured on December 1, 2022, for Teachers Insurance and Annuity Association of America (TIAA) in a Second Circuit decision that vacated the district court's certification of a nationwide class of 8,000 retirement plans, with hundreds of thousands of plan participants and covering hundreds of thousands of transactions.

0Upcoming Events

- Speaking Engagement: NAPA 401(k) Summit (April 1, 2023)

Jamie Fleckner is speaking at the upcoming 2023 NAPA 401(k) Summit session, “Suit ‘Routes’: Lessons Learned from Litigation,” to discuss key updates and the latest trends impacting the retirement industry.

- Goodwin Webinar Series: 2023 Goodwin CLE Days Program (January 18–19, 2023)

Goodwin is hosting its seventh annual CLE Days webinar series, which will highlight the latest business trends and provide updates on the legal and regulatory landscapes throughout a variety of sectors. Goodwin’s CLE Days will offer CLE credits for CA, FL, NY, NJ, CT, PA, and TX.

Contacts

- /en/people/f/fleckner-james

James O. Fleckner

PartnerChair, ERISA Litigation - /en/people/d/douglass-alison

Alison V. Douglass

Partner

Editors

- /en/people/r/rosenberg-dave

Dave Rosenberg

Counsel - /en/people/h/hennecken-christina

Christina L. Hennecken

Partner - /en/people/r/riffee-matthew

Matthew L. Riffee

Partner