Key persons are investment professionals who are considered indispensable to a fund’s investment activities. The identity and number of key persons depends on a variety of factors, including fund type and size. For example, the key persons at a start-up could be the founders. For institutional managers covering multiple asset classes, key persons are more likely to be heads of business lines or managers at a similar level.

A “key person event” occurs when a certain number of key persons are no longer involved in the management of the fund, either because they have left entirely or because they failed to devote the required amount of time as stipulated in the fund documents, which may be in relation to the particular fund, the wider strategy, or the entire business of the sponsor. If a key person event does occur, it typically triggers a period of suspension during which the fund is not able to make new investments. Resolving a key person event and suspension of new investments typically can take one of two forms: managers may seek to replace the key persons in question (which generally requires approval of investors or the investor advisory committee) or seek to reassure investors that the fund can implement its strategy without a replacement.

Analysis of Goodwin’s Terms Database for Private Investment Funds shows that most private equity, real estate, venture capital, debt, and infrastructure funds (88%) automatically suspend the investment period when a key person event occurs.

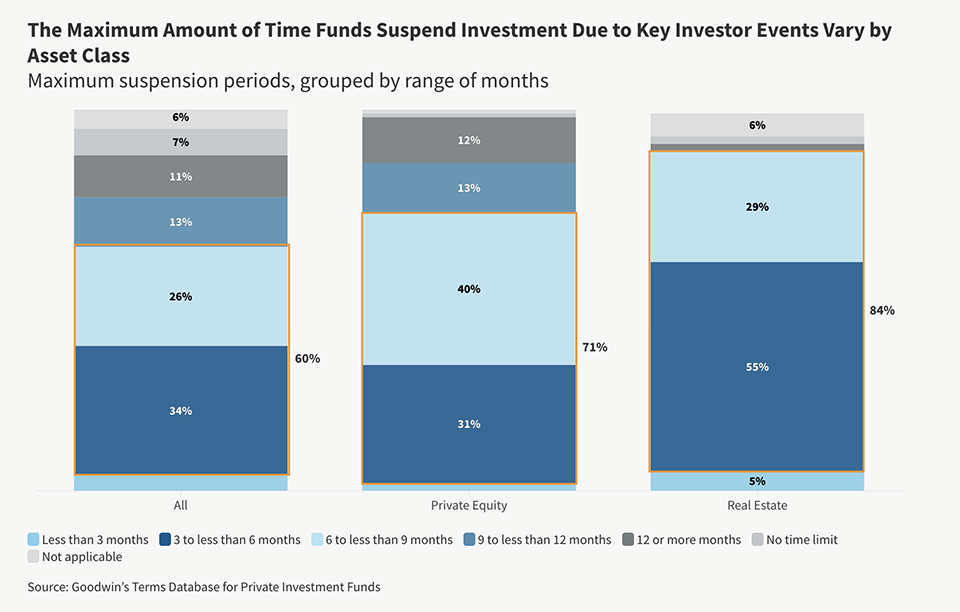

Funds that automatically suspend the investment period usually set a maximum time limit for the suspension. Considered together, a majority of these funds (60%) set their maximum suspension period within a range of three to nine months, although about a quarter set the maximum at nine months or more.

The picture changes when funds are considered by asset class. A larger percent of private equity funds (71%) and real estate funds (84%) set their maximum suspension period within a range of three to nine months. But real estate funds are more likely to have a shorter suspension period than other asset classes. A majority of real estate funds (55%) set the maximum within a range of three to six months. Private equity funds (40%) are more likely to set the maximum within a range of six to nine months.

Suspension periods set by venture capital and infrastructure funds tend to track those of private equity funds. Debt funds are the most likely to set the maximum at 12 months or longer (30%).

The advantage of longer suspension periods is that they give managers more time to develop effective plans to resume new investing, which usually require investor approval. Managers may persuade investors to “make up for lost time” by extending the original investment period. The disadvantages of longer suspensions are that sponsors are more likely to miss out on investment opportunities and investors may become dissatisfied with a lack of progress.

Up Next

In our next article, we examine voting thresholds required to resolve key person events, which enable funds to resume making new investments. We also consider the potential consequences when no resolution is reached before the end of the suspension period.

This informational piece, which may be considered advertising under the ethical rules of certain jurisdictions, is provided on the understanding that it does not constitute the rendering of legal advice or other professional advice by Goodwin or its lawyers. Prior results do not guarantee a similar outcome.

Contacts

- /en/people/m/mudakavi-bhargavi

Bhargavi Mudakavi

Partner - /en/people/h/howard-thomas

Thomas Howard

Associate - /en/people/o/oneill-brian

Brian O'Neill

Knowledge & Innovation CounselTeam Lead - /en/people/o/ormond-chris

Chris Ormond

Knowledge & Innovation Counsel